How to Get Mortgage in Dubai for Buy a Property

Buying property in Dubai can be both an exciting and complex process especially when you’re using a mortgage. In this guide we’ll walk through the key steps, make sense of the required players (like the Dubai Land Department (DLD), Real Estate Regulatory Agency (RERA), brokers and agents), and explain how to navigate the process of obtaining a mortgage in the Dubai real estate market. Here’s a complete guide how to get mortgage in Dubai when buying a property.

1. Understand the Dubai Real Estate Market & Legal Framework

Before you apply for a mortgage, it’s important to get familiar with the broader context of buying property in Dubai:

-

-

The property must typically be located in a zone where foreign ownership or freehold ownership is permitted these zones are regulated in the Dubai property market and overseen by RERA.

-

The Dubai Land Department (DLD) is the key government body for registration of property titles and mortgages in Dubai.

-

The real estate industry is regulated to protect buyers and lenders, so understanding the Dubai laws around mortgages and property is vital. For example, the mortgage must be registered with the DLD.

-

As part of the ecosystem you will engage with a real estate agent in Dubai (or a real estate broker) to help find the right property, negotiate terms, and guide you through compliance with local requirements.

-

2. Prepare your Eligibility and Financial Profile

Once you decide to buy, you’ll need to make sure your financial profile meets the lending requirements for a mortgage in Dubai:

-

-

Lenders will assess your income, employment stability (for salaried persons) or 2+ years of business activity (for self-employed) in case of expatriates.

-

Your debt-to-income ratio will be considered the amount you borrow plus other obligations shouldn’t exceed certain thresholds.

-

You’ll need to make a minimum down payment. For example, many expats buying a property under AED 5 million need to put at least 25% down (plus fees) and for properties above that the percentage may be higher.

-

Credit history matters banks in Dubai will check your credit bureau report and assess your financial discipline.

-

If you’re an expat, you must also ensure you’re buying in a permissible freehold zone, and the property meets the bank’s criteria (for example approved developer, correct title, etc.).

-

3. Get Mortgage Pre-approval

A key step is to apply for pre‐approval from a bank to know how much you can borrow and to strengthen your bargaining power.

-

-

Pre-approval usually takes a few working days once you submit your documents and can be valid for 60-90 days.

-

At the pre-approval stage your bank will request: passport/ID, residence visa (if applicable), salary certificate or business audited accounts, bank statements, etc.

-

Having pre-approval shows sellers and a real estate agent in Dubai that you are serious and financially eligible.

-

4. Choose the Property & Sign the Sales & Purchase Agreement (SPA)

With your budget set, you can engage a trusted real estate agent in Dubai or real estate broker to identify suitable properties.

-

-

Once you agree with the seller, you’ll sign an agreement (often a Memorandum of Understanding) and pay a booking deposit.

-

Check that the property is approved by the DLD and meets bank mortgage criteria (i.e., built vs off-plan, developer credibility, property documentation). For off-plan properties, financing may be more restricted.

-

5. Full Mortgage Application, Property Valuation and Approval

After selecting the property, you apply formally to the bank for full mortgage approval:

-

-

The bank will conduct a property valuation to ensure the price aligns with market value. Typical valuation fees are around AED 2,500-3,500.

-

The bank issues a Letter of Offer with the terms: loan amount, interest rate (fixed or variable), tenure, repayment schedule.

-

Once you accept the offer, you sign the mortgage contract with the bank.

-

6. Transfer and Registration with DLD

Once the mortgage is approved and contract signed:

-

-

You will pay the DLD transfer fee (typically 4% of property value) plus other trustee or conveyance fees.

-

The mortgage must then be registered with the DLD. Mortgage registration fee is often 0.25% of the loan amount plus fixed AED fee.

-

After registration, the title deed is transferred in your name or in the bank’s favour (depending on the loan structure) and you can take ownership.

-

7. Monitor your Repayments and Maintain Compliance

Once everything is done and you’re in your property:

-

-

Make sure you service your mortgage payments on time. Defaulting can trigger enforcement under Dubai mortgage law (for example the process of attaching and auctioning property under Dubai Mortgage Law (Dubai Law No. 14 of 2008)).

-

Keep your property insurance and life insurance (if required by the lender) up to date.

-

Stay aware of changes in the Dubai real estate market and any regulation changes from RERA or the DLD, in case you refinance or pay off early.

-

If you intend to sell or refinance, be aware of early settlement penalties and transfer costs.

-

8. Key Costs & Fees to Plan for

When planning your budget for buying a property with a mortgage in Dubai, don’t overlook the extra costs:

-

-

Down payment (minimum 20-25% for many expats) plus booking deposit.

-

DLD transfer fee (~4% of property price) and mortgage registration fee (~0.25% of loan amount) plus small fees.

-

Valuation fee (AED 2,500-3,500) and bank processing fee (~1% of loan amount) for many lenders.

-

Property insurance and life insurance (if required).

-

Real estate agent or broker commission (often 2% of purchase price) and developer NOC or service charges if applicable.

-

For More Details

Call Us Today: +971585782394

9. Common Pitfalls and How to Avoid Them

-

Insufficient down payment: If you don’t provide the required minimum down payment the bank may decline your application.

-

Ineligible property: If the unit isn’t in an approved freehold zone, or is off-plan without lending eligibility.

-

Missing documents or weak credit history: Lenders will reject if employment or income isn’t verifiable.

-

Underestimating costs: Many buyers focus only on monthly payments and forget upfront fees and transfer costs.

-

Changes in regulation: Always work with a real estate agent in Dubai who is familiar with the current rules set by the DLD and RERA.

-

Interest rate risk: If you choose a variable rate mortgage, your payments could increase with future interest rate rises.

10. Final checklist before you commit

-

Pre-approval letter secured.

-

Down payment and upfront fees budgeted.

-

Property inspected and valuation understood.

-

Mortgage offer accepted and contract signed.

-

DLD transfer and registration scheduled.

-

Insurance cover arranged (property & life).

-

Monthly budget set for repayments, service charges, maintenance.

-

Clear understanding of resale or exit strategy.

Conclusion: How to Get Mortgage in Dubai for Buy a Property

Buying property in Dubai and obtaining a mortgage involves many moving parts from understanding DLD and RERA regulations to selecting the right property and coordinating with banks for mortgage approval. With Hira Holdings Dubai, clients benefit from professional real estate brokers who provide expert guidance, handle all legal and financial procedures, and ensure a transparent, stress-free buying experience.

By trusting Hira Holdings Dubai, you can confidently navigate the Dubai property market and secure your dream home with ease.

Starting a career as a freelance real estate agent in Dubai requires a clear understanding of the legal requirements, market dynamics, and licensing procedures. With Dubai’s property sector offering vast opportunities, following the right process ensures you build a compliant and successful freelance career.

Starting a career as a freelance real estate agent in Dubai requires a clear understanding of the legal requirements, market dynamics, and licensing procedures. With Dubai’s property sector offering vast opportunities, following the right process ensures you build a compliant and successful freelance career.

Before becoming a certified real estate broker in Dubai, it’s important to understand the financial requirements involved in the licensing process. The cost of obtaining a Real Estate Broker (RERA) License can vary depending on your educational background, visa status, and the type of setup (individual agent or brokerage firm). Below is a clear breakdown of the main expenses you should expect when applying for your license in Dubai.

Before becoming a certified real estate broker in Dubai, it’s important to understand the financial requirements involved in the licensing process. The cost of obtaining a Real Estate Broker (RERA) License can vary depending on your educational background, visa status, and the type of setup (individual agent or brokerage firm). Below is a clear breakdown of the main expenses you should expect when applying for your license in Dubai.

How does that operate? UAE has seen a huge number of investors from the foreign market such as Chinese, Russians, Ukrainians, Europeans, and so on. In order to ensure that UAE is a safe haven for all those investors, UAE established escrow accounts to secure customer protection. Escrow accounts are deposit-only accounts with the DLD and the developer as the only account holders. When a developer announces a project, they contribute 40% of the total cost before beginning marketing. When buyers deposit money into an escrow account, the DLD verifies the construction and releases funds to the developer so they can continue to build.

How does that operate? UAE has seen a huge number of investors from the foreign market such as Chinese, Russians, Ukrainians, Europeans, and so on. In order to ensure that UAE is a safe haven for all those investors, UAE established escrow accounts to secure customer protection. Escrow accounts are deposit-only accounts with the DLD and the developer as the only account holders. When a developer announces a project, they contribute 40% of the total cost before beginning marketing. When buyers deposit money into an escrow account, the DLD verifies the construction and releases funds to the developer so they can continue to build. The UAE’s real estate market in 2025 is experiencing strong growth, driven by increased demand and investment, particularly in Dubai. While prices are rising, developers are also focusing on affordable and mid-range housing. Dubai’s real estate market has seen significant growth in both sales and rentals, with property values increasing and high transaction volumes. The UAE real estate market, especially in Dubai, is resilient and continues to grow. Dubai’s pro-business policies, population growth, and continuous infrastructure development ensure that the Dubai real estate market stays active and promising.

The UAE’s real estate market in 2025 is experiencing strong growth, driven by increased demand and investment, particularly in Dubai. While prices are rising, developers are also focusing on affordable and mid-range housing. Dubai’s real estate market has seen significant growth in both sales and rentals, with property values increasing and high transaction volumes. The UAE real estate market, especially in Dubai, is resilient and continues to grow. Dubai’s pro-business policies, population growth, and continuous infrastructure development ensure that the Dubai real estate market stays active and promising. Dubai’s strategic location as a global hub significantly bolsters its real estate market. Situated at the crossroads of Europe, Asia, and Africa, it acts as a gateway for international trade and investment, attracting businesses and investors from around the world. This combined with its luxury infrastructure and business-friendly policies, this makes real estate in Dubai particularly appealing to international investors who want a strategic base for business and lifestyle.

Dubai’s strategic location as a global hub significantly bolsters its real estate market. Situated at the crossroads of Europe, Asia, and Africa, it acts as a gateway for international trade and investment, attracting businesses and investors from around the world. This combined with its luxury infrastructure and business-friendly policies, this makes real estate in Dubai particularly appealing to international investors who want a strategic base for business and lifestyle. Dubai’s real estate market stands out globally due to its tax-free environment, offering significant advantages to investors. Unlike many countries, Dubai imposes no property taxes, capital gains taxes, or taxes on rental income. This means that property buyers in Dubai can retain 100% of their rental earnings and profits from property sales, enhancing the appeal of Dubai properties for sale. This tax-friendly framework has attracted numerous Dubai real estate companies and agencies, facilitating seamless transactions for both local and international investors.

Dubai’s real estate market stands out globally due to its tax-free environment, offering significant advantages to investors. Unlike many countries, Dubai imposes no property taxes, capital gains taxes, or taxes on rental income. This means that property buyers in Dubai can retain 100% of their rental earnings and profits from property sales, enhancing the appeal of Dubai properties for sale. This tax-friendly framework has attracted numerous Dubai real estate companies and agencies, facilitating seamless transactions for both local and international investors. Dubai’s real estate sector has always produced great returns on investment. One of the strongest reasons to invest in Dubai property is the high rental yield. On average, Dubai real estate offers a gross rental yield of 6%–10%, which is significantly higher than many major cities such as London, New York, or Singapore.

Dubai’s real estate sector has always produced great returns on investment. One of the strongest reasons to invest in Dubai property is the high rental yield. On average, Dubai real estate offers a gross rental yield of 6%–10%, which is significantly higher than many major cities such as London, New York, or Singapore. Dubai has luxury infrastructure. This infrastructure includes a world-class transportation network (metro, roads, airports), smart city initiatives, state of the art healthcare facilities, excellent educational institutions and sustainable developments, all attracting both investors and resident. Investors can choose from a wide variety of Dubai properties for sale, including

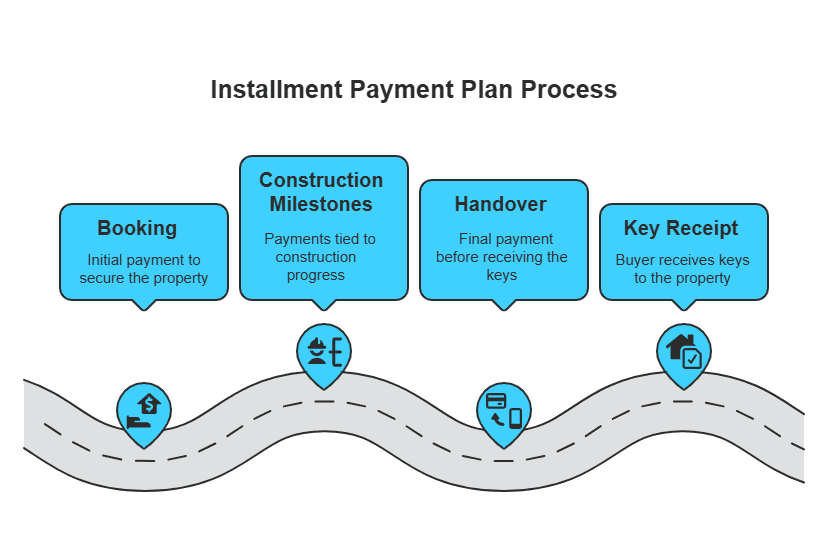

Dubai has luxury infrastructure. This infrastructure includes a world-class transportation network (metro, roads, airports), smart city initiatives, state of the art healthcare facilities, excellent educational institutions and sustainable developments, all attracting both investors and resident. Investors can choose from a wide variety of Dubai properties for sale, including  In Dubai’s real estate market, several convenient payment plans are available for property buyers, including standard construction-linked plans, post-handover options, 1% monthly plans, and rent-to-own schemes. These plans offer flexibility and cater to different financial situations, making property ownership more accessible. Post-handover payment plan allows Dubai property buyers to pay a portion of the property price before handover and the remaining amount in installments over a period, often several years, after taking possession.

In Dubai’s real estate market, several convenient payment plans are available for property buyers, including standard construction-linked plans, post-handover options, 1% monthly plans, and rent-to-own schemes. These plans offer flexibility and cater to different financial situations, making property ownership more accessible. Post-handover payment plan allows Dubai property buyers to pay a portion of the property price before handover and the remaining amount in installments over a period, often several years, after taking possession. Dubai’s real estate market offers competitive pricing, especially when compared to other major global cities. While luxury properties in prime areas like Downtown Dubai and Palm Jumeirah command high prices, the overall cost of living and property ownership in Dubai is lower than in cities like London, New York, or Hong Kong. Factors like location, property type, and project status significantly influence prices, with emerging communities offering more affordable options.

Dubai’s real estate market offers competitive pricing, especially when compared to other major global cities. While luxury properties in prime areas like Downtown Dubai and Palm Jumeirah command high prices, the overall cost of living and property ownership in Dubai is lower than in cities like London, New York, or Hong Kong. Factors like location, property type, and project status significantly influence prices, with emerging communities offering more affordable options. Dubai’s tourism sector is booming, drawing millions each year. Additionally, the population continues to grow, driving demand for rental housing and boosting the overall health of the Dubai real estate and UAE real estate market. Dubai’s soaring population has become a powerful catalyst powering demand within the Dubai real estate sector.

Dubai’s tourism sector is booming, drawing millions each year. Additionally, the population continues to grow, driving demand for rental housing and boosting the overall health of the Dubai real estate and UAE real estate market. Dubai’s soaring population has become a powerful catalyst powering demand within the Dubai real estate sector.